طرحهای پژوهشی

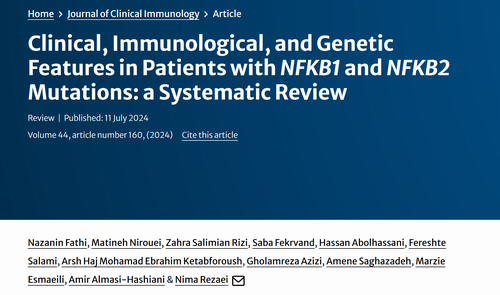

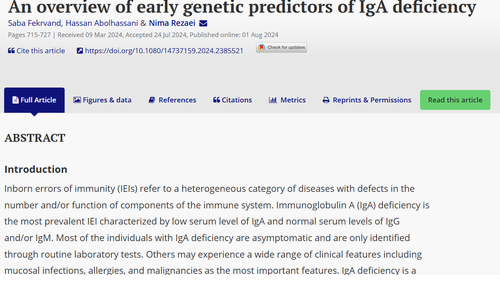

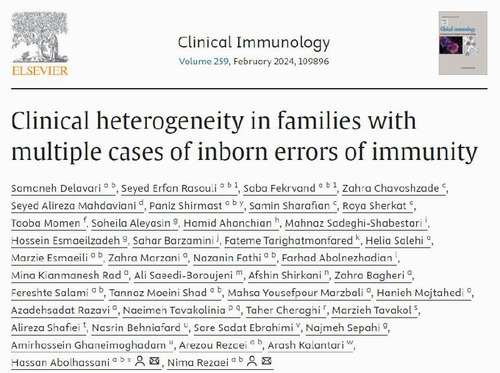

مقالات علمی

مرکز تحقیقات در یک نگاه

مطالب آموزشی

اخبار مرکز

دومین نمایشگاه دستاوردهای علمی ،پژوهشی دانشگاه تهران و دانشگاه علوم پزشکی تهران شماره دو

پیام تبریک رئیس دانشکده بهداشت به مناسبت روز استاد

قدردانی شهردار تهران از یکی از اعضا هیات علمی دانشکده بهداشت در مراسم تقدیر از جهادگران عرصه سلامت

گزارشی از روند برگزاری مدرسه میدانی سلامت در بلایای کشور

گزارشی از روند برگزاری مدرسه میدانی سلامت در بلایای کشور

_1.png)

_2.jpg)